Did you know that 64% of Americans struggle to stick to a budget? With the constant temptation of impulse purchases and unexpected expenses, managing personal finances can be a daunting task.

Fortunately, there’s a solution that can help you take control of your money and make budgeting a breeze. Introducing the Snoop app – a powerful tool designed to provide comprehensive insights into your spending habits and streamline your financial management.

Created in 2019, the Snoop app has quickly gained popularity for its user-friendly interface and robust features. Whether you’re looking to track your spending, create budgets, or find the best deals on financial products, Snoop has you covered.

But what sets Snoop apart from other budgeting apps? In this comprehensive review, we’ll dive into the key features of the Snoop app, its pricing options, and who would benefit the most from using it. Let’s explore why Snoop is worth considering for your financial goals.

Key Takeaways:

- Snoop is a budgeting app designed to help users gain insights into their spending habits and streamline their financial management.

- With features like account linking, spending tracking, and personalized money-saving suggestions, Snoop provides a comprehensive solution for budgeting.

- While the basic version of the app is free, users can upgrade to Snoop Plus for additional tools and features.

- Snoop is suitable for individuals who want to take control of their finances and make informed decisions about their money.

- By using Snoop, users can track their spending, create budgets, receive bill reminders, and find deals on financial products.

Key Features of Snoop App

Snoop, a leading money management app, offers an array of innovative features to help users take control of their finances. With its intuitive interface and seamless integration with multiple bank accounts, Snoop revolutionizes personal finance management. Explore the key features of Snoop App that make it a popular choice among individuals seeking effective money management solutions.

Open Banking Integration for Streamlined Tracking

Snoop allows users to link multiple bank accounts, enabling them to access and manage all their financial data in a single place. By streamlining the tracking process, users can easily monitor their transactions, balances, and budgets. The convenience of open banking integration ensures a comprehensive view of their financial health at any given time.

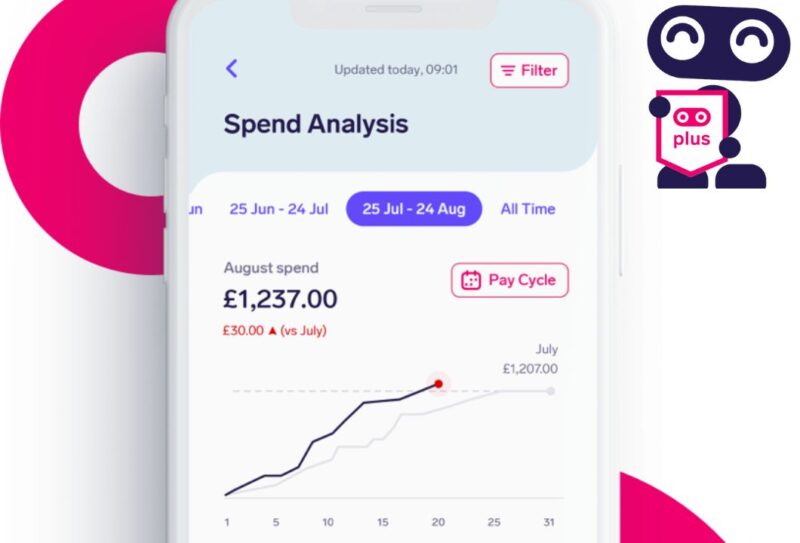

Automatic Categorization and Custom Spending Reports

One of the standout features of Snoop App is its ability to automatically classify spending. The app intelligently organizes transactions into various categories, providing users with detailed insights into their expenses. Additionally, users can generate weekly and monthly spending reports, empowering them to analyze their financial habits and identify areas for improvement.

Effortless Budgeting and Expenditure Planning

Snoop simplifies budgeting by empowering users to create personalized monthly budgets. With a few simple steps, users can set spending limits for different categories and track their progress throughout the month. By keeping a close eye on their expenditure, users can effectively manage their finances and avoid overspending.

Built-in Comparison Tool

Save money effortlessly with Snoop’s built-in comparison tool. The app analyzes users’ financial habits and recommends the best deals on a wide range of financial products and services. From credit cards to insurance policies, Snoop ensures users make informed decisions and secure the most favorable options available in the market.

Upcoming Bill Reminders and Personalized Money-Saving Suggestions

Snoop keeps users informed about upcoming bills to help them stay on top of their financial obligations. By setting reminders, users never miss a payment deadline again. Furthermore, the app provides tailored money-saving suggestions based on users’ spending patterns, helping them make smarter choices and maximize their savings potential.

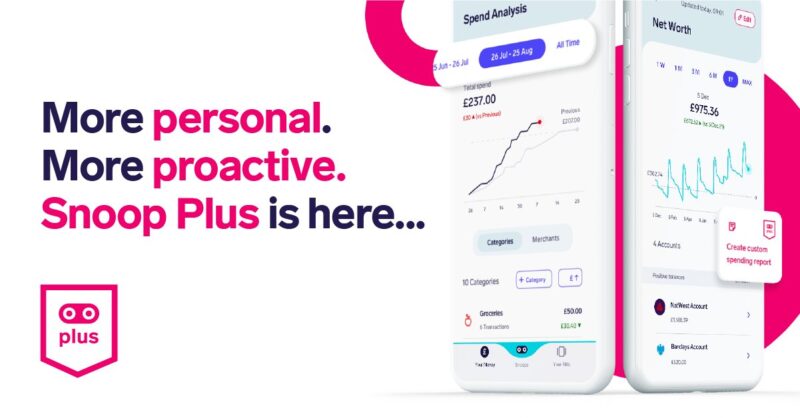

Snoop Plus: Enhanced Features for Advanced Money Management

For users seeking additional functionalities, Snoop Plus offers an upgraded experience. Subscribers to Snoop Plus enjoy exclusive benefits, including the ability to track net worth, set custom spending categories, and receive unlimited alerts for spending and refunds. These enhanced features cater to users with complex financial portfolios or those seeking an all-encompassing money management solution.

Discover the power of Snoop App and take charge of your financial journey today. With its comprehensive set of features, Snoop simplifies money management, enabling users to achieve their financial goals with ease.

Pricing and Suitability of Snoop App

Snoop offers two pricing plans for users to choose from, catering to different budgeting needs and preferences. Let’s take a closer look at the features and affordability of each plan:

1. Free Version

With the free version of Snoop, users can access a range of essential budgeting features that help with financial management:

- Account Linking: Connect and view multiple bank accounts in one place.

- Spending Breakdowns: Gain insights into your spending patterns and identify areas for improvement.

- Bill Reminders: Receive alerts and reminders about upcoming bills.

This version of Snoop is a great starting point for users looking to get a glimpse of the app’s capabilities without any financial commitments. It provides a solid foundation for managing personal finances effectively and making informed spending decisions.

2. Snoop Plus Plan

For users looking for additional budgeting tools and more comprehensive money tracking, Snoop offers the Snoop Plus plan:

- Features: In addition to the features available in the free version, Snoop Plus unlocks the following tools:

| Snoop Plus Plan | Pricing |

|---|---|

| Tracking Net Worth | £4.99 per month or £31.99 per year |

| Creating Unlimited Custom Spending Categories |

The Snoop Plus plan enables users to track their net worth, providing a comprehensive overview of their financial health. It also allows for the creation of unlimited custom spending categories, providing users with increased flexibility in their budgeting process.

For those who require more advanced money management features and a deeper understanding of their finances, the Snoop Plus plan offers excellent value for money. By paying a monthly or yearly subscription fee, users can take full advantage of Snoop’s advanced tools and features to enhance their financial well-being.

The image above showcases the user-friendly interface of the Snoop app, making budgeting and financial management a seamless experience.

Now that you’re aware of the pricing options and features offered by Snoop, it’s time to evaluate whether the app is worth your investment. Let’s move on to the final section of this Snoop App Review to draw a conclusion. If you liked this article, be sure to also check out our article about: Top UK Banks for Trust Accounts

Conclusion

In conclusion, Snoop is a comprehensive budgeting app that aims to simplify financial management for users. With its ability to link multiple accounts, track spending, create budgets, and provide money-saving suggestions, Snoop offers a range of useful tools.

While some features are only available to paid subscribers, the free version still provides access to many of the app’s key features. Whether you’re looking to gain insights into your spending habits or find ways to save money, Snoop is worth considering.

However, if you’re seeking investment options or automated saving features, you may need to explore other apps or platforms. Overall, Snoop is a user-friendly app that can enhance your financial management and make budgeting seamless.

FAQ

What is Snoop App?

Snoop App is a budgeting app launched in 2019 that helps users manage their finances by offering features such as account linking, spending tracking, budget creation, bill reminders, and personalized money-saving suggestions.

Is Snoop App free?

Yes, Snoop App offers a free version that provides access to most of its features, including account linking, spending breakdowns, and bill reminders.

What is Snoop Plus?

Snoop Plus is the paid-for version of Snoop App that unlocks additional budgeting and money tracking tools, such as tracking net worth and creating unlimited custom spending categories.

How much does Snoop Plus cost?

Snoop Plus is priced at £4.99 per month or £31.99 per year.

Are all features available in the free version?

While the free version of Snoop App provides access to most features, some advanced features, such as tracking net worth and setting custom spending categories, are exclusive to Snoop Plus subscribers.

Can Snoop App help me save money?

Yes, Snoop App offers personalized money-saving suggestions based on your spending habits and provides a built-in comparison tool to help you find deals on financial products and services.

Can I use Snoop App to track spending from multiple accounts?

Yes, Snoop App allows you to link multiple bank accounts and view them all in one place, making it easy to track spending across different accounts.

Does Snoop App provide spending reports?

Yes, Snoop App automatically categorizes your spending and provides weekly and monthly spending reports to help you gain insights into your spending habits.

Does Snoop App offer bill reminders?

Yes, Snoop App provides reminders for upcoming bills, ensuring that you stay on top of your financial obligations and avoid late payments.

Is Snoop App suitable for individuals looking to streamline their financial management?

Yes, Snoop App is suitable for individuals who want to gain insights into their spending habits, create budgets, and receive helpful money-saving suggestions to streamline their financial management.

Can I access Snoop App’s features without an internet connection?

No, Snoop App requires an internet connection to sync your accounts, track spending, and provide real-time updates on your financial information.